GSTR & e-Way Bill Solution

Simplified GST enablement for SAP

Customers – (e-Way bill & GSTR filings)

The e-Way bill is an electronically generated document which is required for the movement of goods of value more than INR 50000, from one location to another. This document is generated online on the National Informatics Centre (NIC) portal for transportation of goods, both inter and intra state and includes details such as name of consignor, consignee, point of origin of consignment, consignment destination and route. Goods and Services Tax (GST) regime has mandated the generation of the e-Way bill from 1st April 2018.

ENTUNE is one of the earliest & proactive SAP partner company in delivering GST related enhancement to its customers. ENTUNE have successfully deployed GST e-Way Bill solution for the SAP customers and supporting the Clients in automating the e-Way bill solution in:

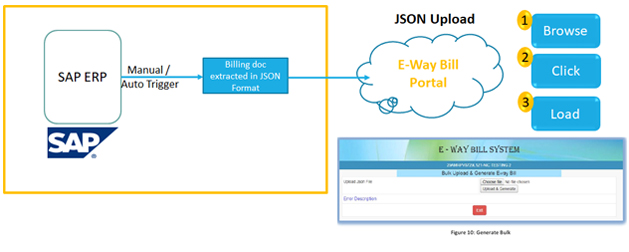

ENTUNE Smart-Shift – 2 Step (off-line) upload option

Tested & proven successfully with Clients running the solution which is deployed in 2-3 working days

GST e-Way bill solution from SAP

Integrate seamlessly with NIC system with complete automation via certified GST Suvidha Providers (GSPs)using SAP Cloud Integration Platform

+91 6364883355

+91 6364883355