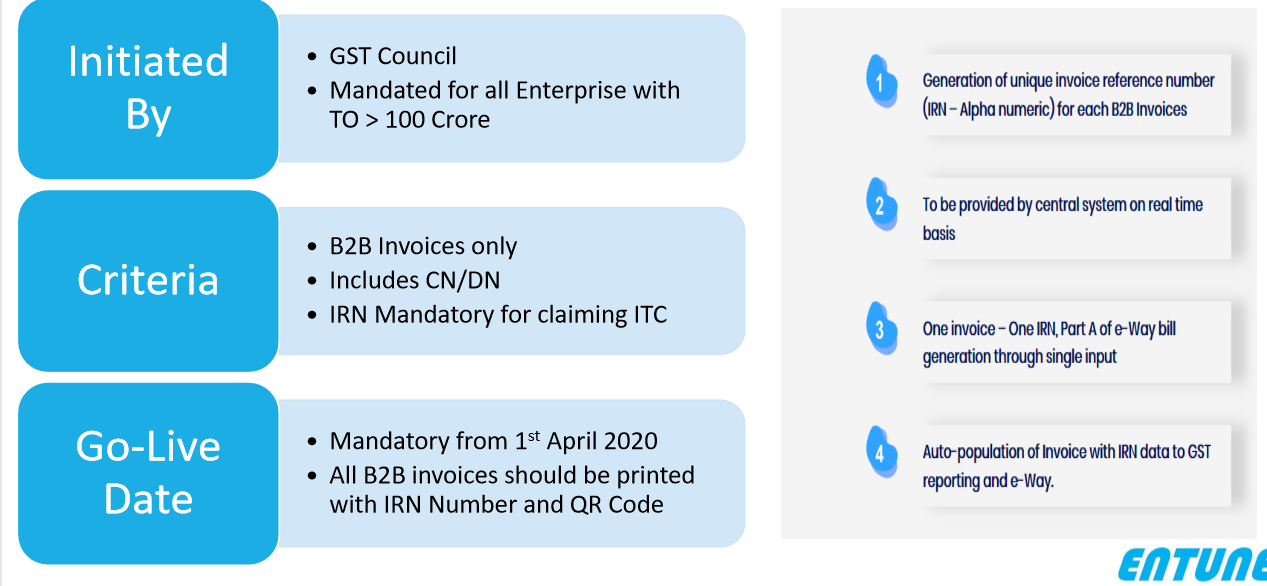

Beginning from this year, the GST council of India has decided to introduce a game-changing invoicing system under the GST regime. A standardized invoicing system called the electronic invoicing or e-Invoicing. In India, it’s going to be a big move owing to the volume of business transactions undertaken every day with the absence of any standardized format used for invoice generation.

As the name suggests, e-Invoicing is a process of validating invoices electronically through the GST network that can be used further on the common GST portal.

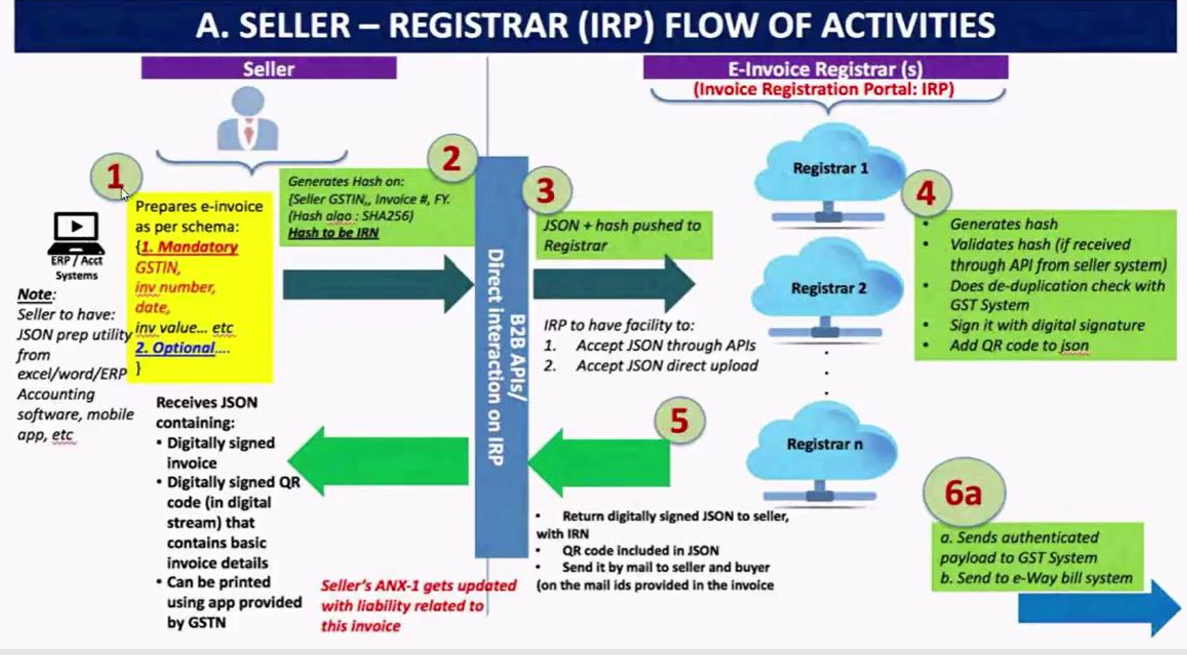

The e-Invoice system proposed by the GST council functions in a standard protocol where an identification number is issued against every invoice by the invoice registration portal (IRP) under GSTN (GST Network).

The taxpayer has to take the responsibility of generating e-Invoices, and he is required to report the same in the invoice registration portal of GST. The portal will generate the IRN (invoice reference number) along with a QR code that contains vital information of the e-Invoice.

Following, the information from IRP is transferred across GST and e-way bill portal instantly and this process also completes the part A of e-Way bill.

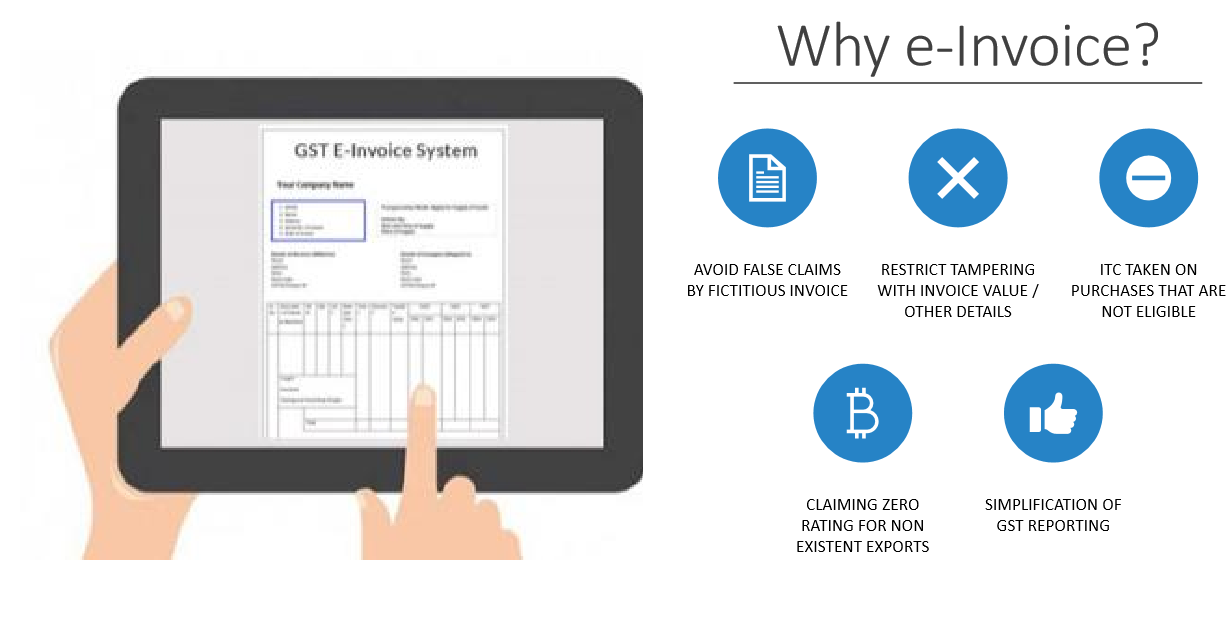

The need of e-Invoicing

-

IRN is mandatory on invoices and it’s a must for availing the credit

-

False filing of credit with bogus invoices causes revenue loss to the government. So, the e-Invoice system can bring a better taxpayer service leading to a reduction in evasion.

-

It helps curb Input tax credit taken on ineligible purchase

-

It also enhances the efficiency of tax administration by setting up companies on paper to generate invoices.

So, What’s the process now

At present, organizations are using different software to generate invoices, and it involves a manual task of uploading those invoices in GSTR-1 return. It then goes to GSTR-2A, and when any transporter needed to generate the e-way bill, they had to import the invoices in excel.

e- Invoice mechanism and its usefulness

-

The e-Invoice system attempts to negate data mismatch errors by confronting the challenges and making better data reconciliation possible.

-

The e-Invoice generation process allows interoperability and hence minimizes the data entry error.

-

The e-Invoice allows real-time tracking of the invoices prepared by the supplier

-

Tax return filing process becomes easier with e-Invoice as the relevant data of the invoices are auto populated when filing different returns.

Let’s dive in detail about e-Invoicing

Any accounting software provider like SAP or Tally has to comply with the PEPPOL standard for invoice generation. It’s an electronic data interchange protocol that stands for (Pan-European Public Procurement On-Line) designed to simplify transaction processes between government bodies and suppliers. In this process, multiple business applications and trading communities are allowed to exchange information using a standard protocol.

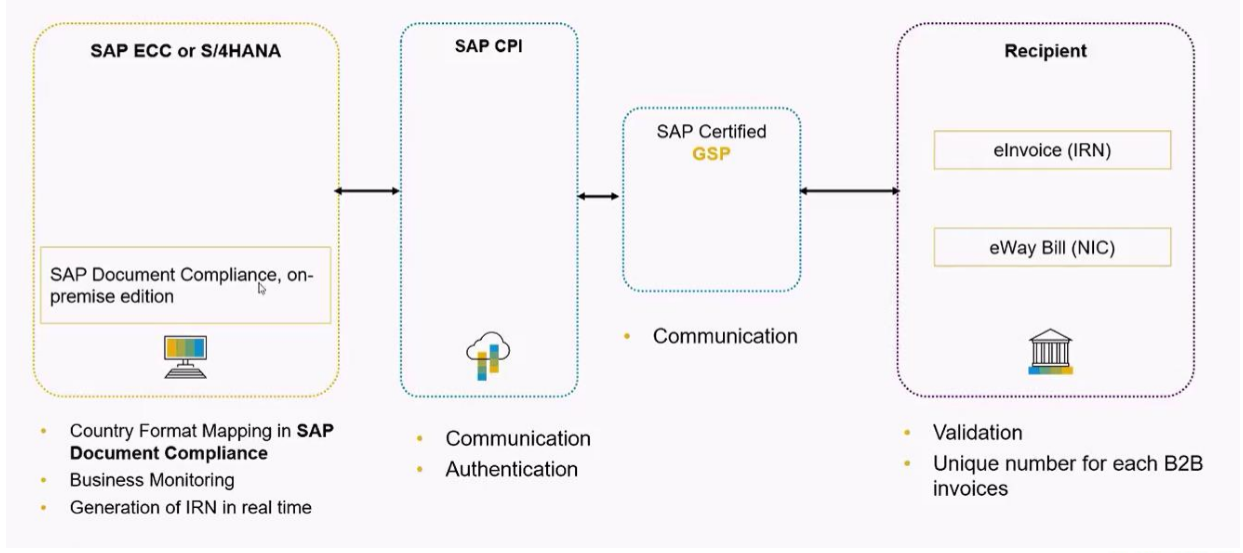

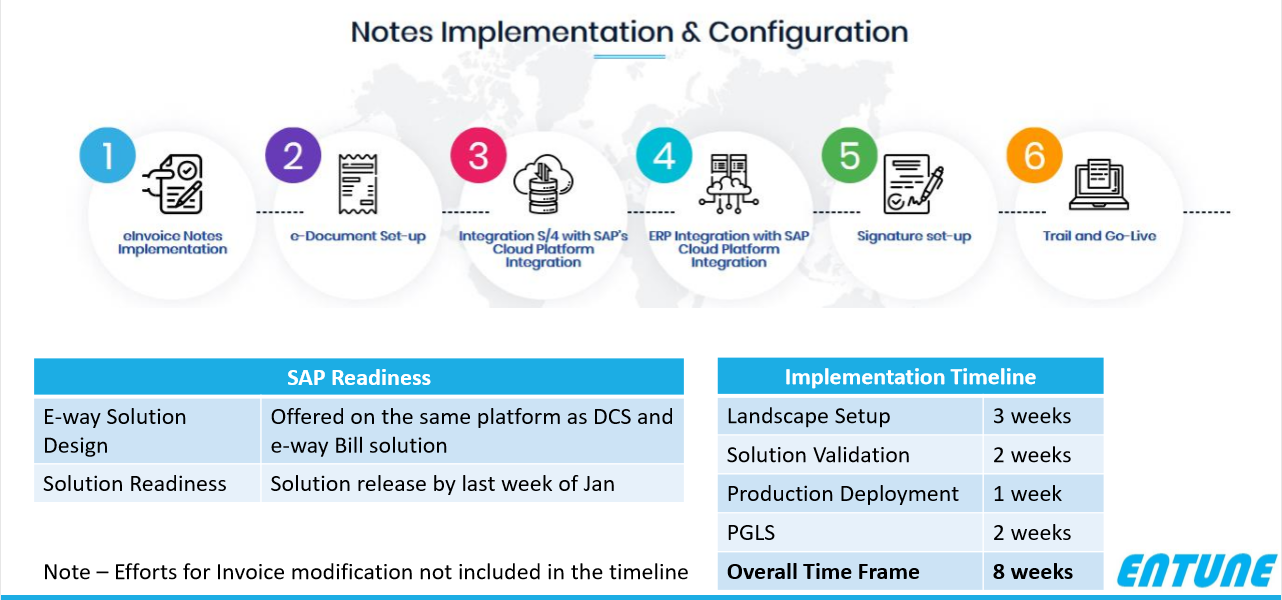

SAP document compliance

With digitalization taking place in every aspect of businesses, the government process is not far behind. An approach towards digitalization in Government procedure has generated the need for electronic tax compliance. The e-Invoice system with country-specific regulatory obligations has become a mandate for businesses in several countries. Sensing the need to integrate all country-specific legal requirements into one solution, SAP has developed its own SAP document compliance solution for SAP ECC and S/4 HANA systems.

Benefits of SAP document compliance for e-Invoicing

Global Platform:

SAP documents compliance is a globally used platform for the e-Invoice generation and real-time reporting.

Health Check:

SAP document compliance ensures the submission of an error-free payload to IRN and NIC portal by validating master and transaction data.

Live status update:

SAP document compliance cockpit offers live status update for each invoice.

Three solutions in one platform:

SAP document compliance consists of e-Invoice (IRN)+e-Waybill +SAP Digital compliance service (GST Reporting) of India in one platform.

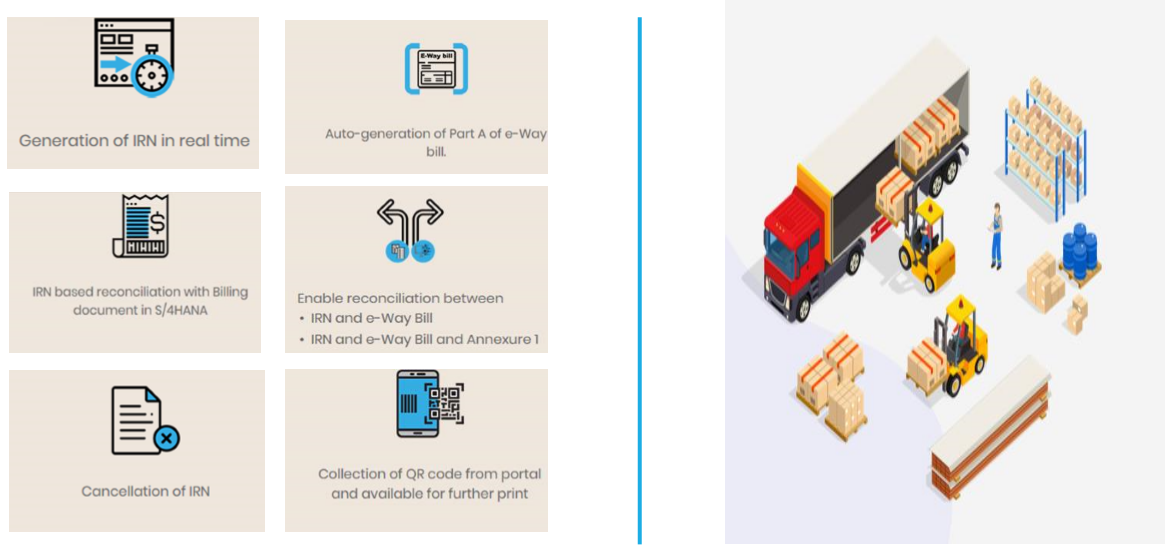

What SAP document compliance can offer

-

Real-time generation of invoices

-

Auto-generation of the part A of e-Way bill When creating e-Invoice

-

Smooth reconciliation between IRN and e-Way bill

-

Cancellation of IRN

SAP document compliances enable you to run business in a world of ever-changing compliances. Whether you’re using SAP ECC or S/4 HANA systems, SAP document compliance solution is designed to help you keep all kinds of compliance and legal requirements under your control.

+91 6364883355

+91 6364883355